New investment platform led a 367% growth in advisors connected to XP's ecosystem.

Rede is a SaaS platform for investment advisors. It improves efficiency, manages client investments, and scales growth, increasing XP's advisor network by 367% since 2024.

Platform for Investment Advisors

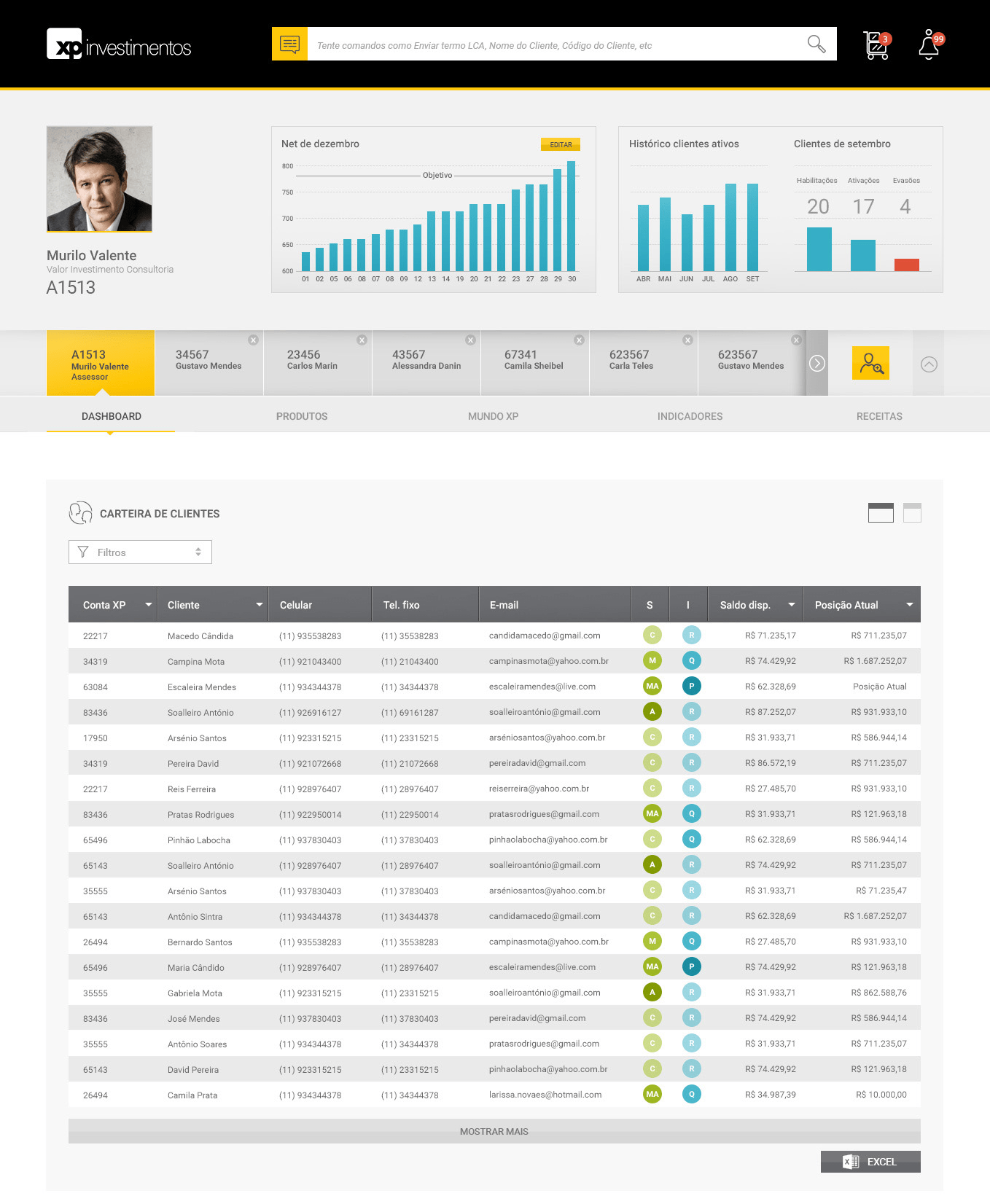

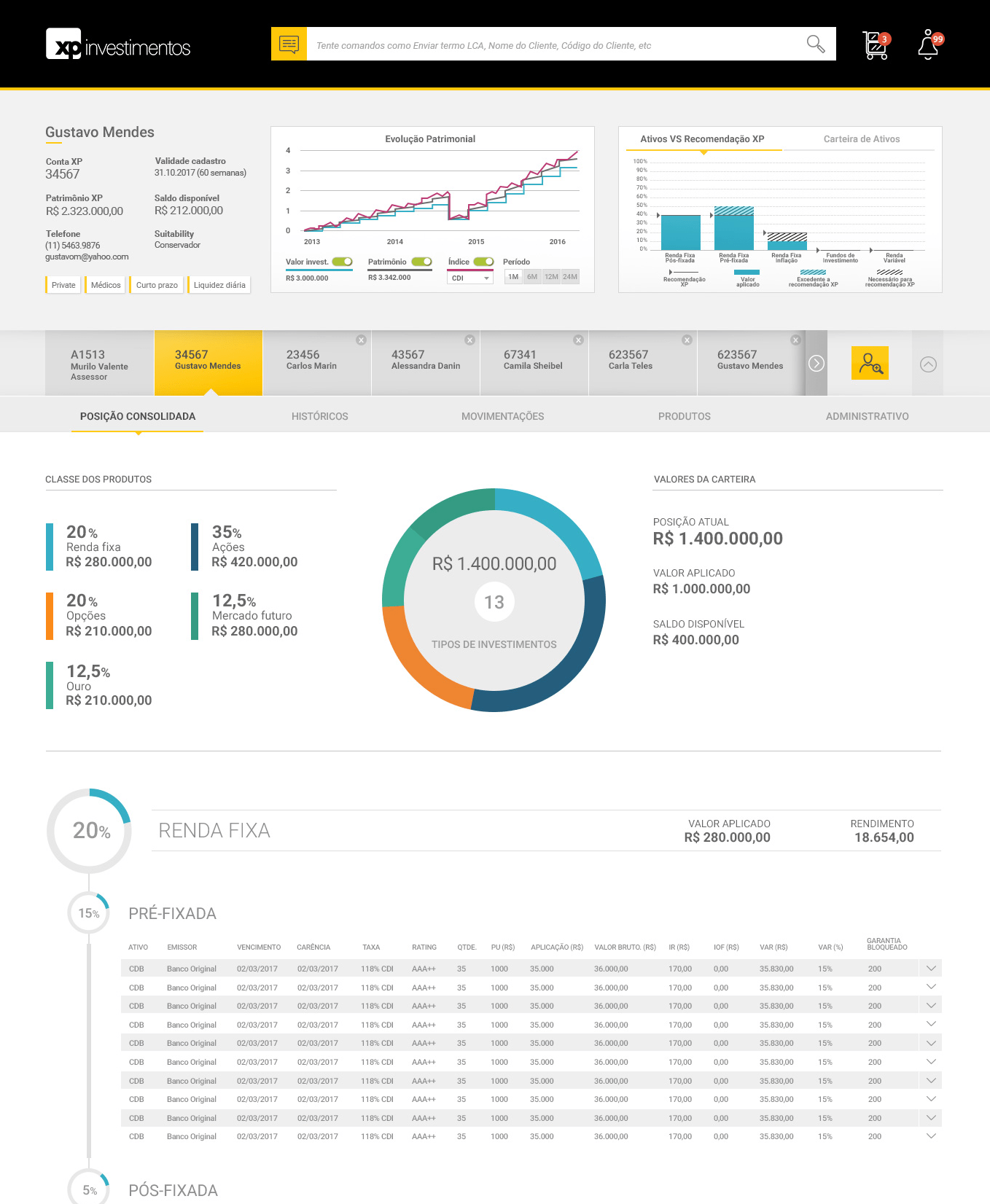

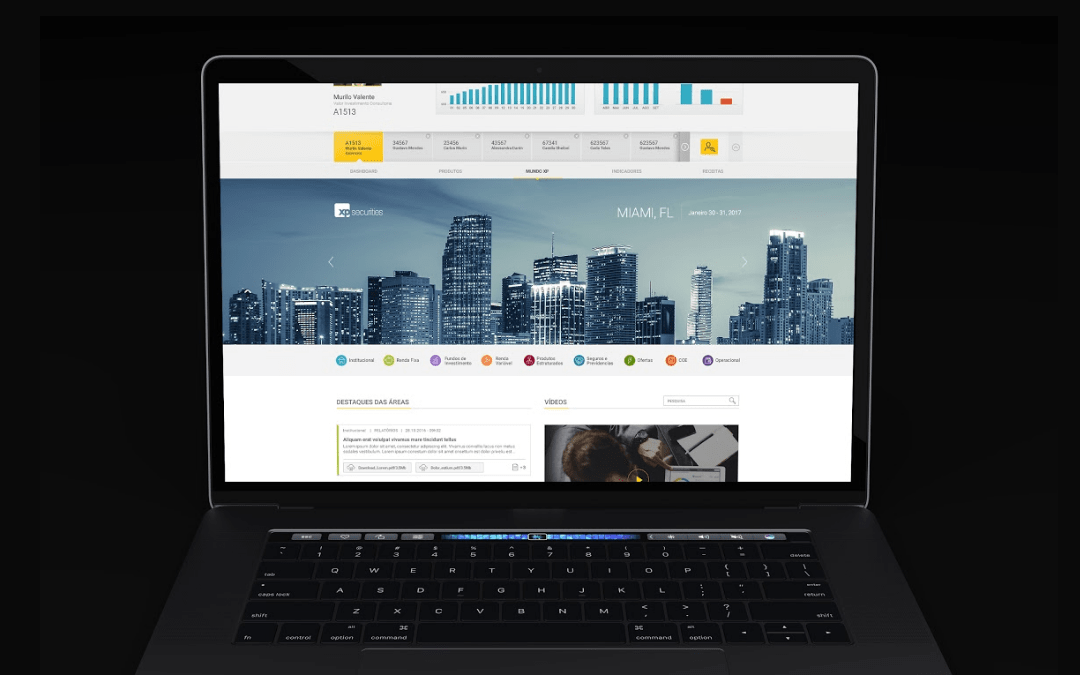

Unified all XP INC tools spread all over its intranet in a coherent XP INC Investment Advisor Experience.

XP INC is the major investment organization in Brazil.

Platform for Investment Advisors

Unified platform for XP network of Investment Advisors. XP INC is the major investment organization in Brazil.

Platform for Investment Advisors

Unified platform for XP network of Investment Advisors. XP INC is the major investment organization in Brazil.

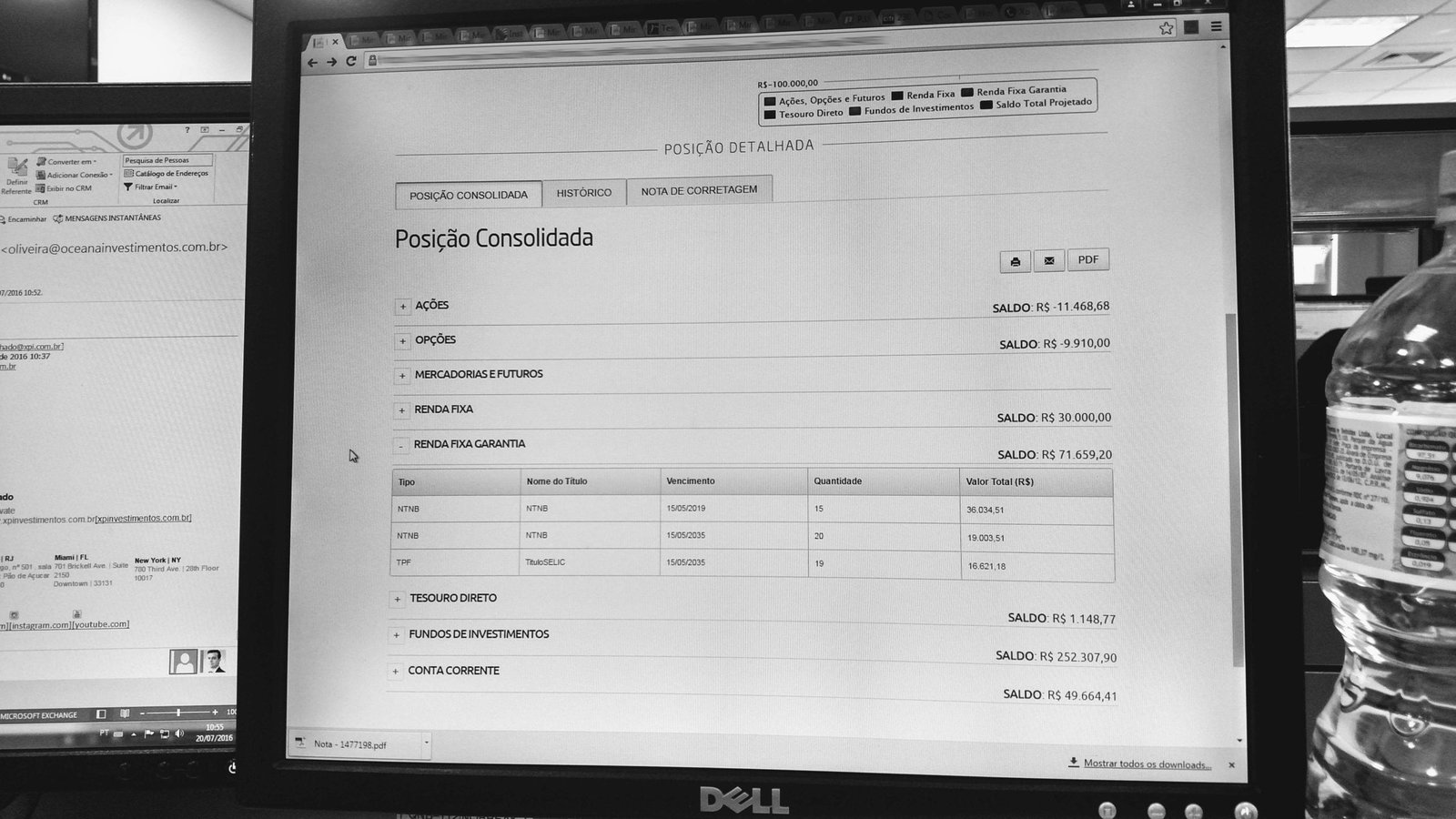

Project Situation

XP needed a competitive platform to expand its network of partner investment offices.

XP's rapid growth outpaced its data systems, leading to the need for integration. The old platform, with its limitations, became a significant obstacle to expanding the partner network.

My Task

I was tasked to redesign the working platform for XP's investment advisors and partner investment offices.

My Actions

I revamped a finance SaaS platform for investment advisors! Here's the story:

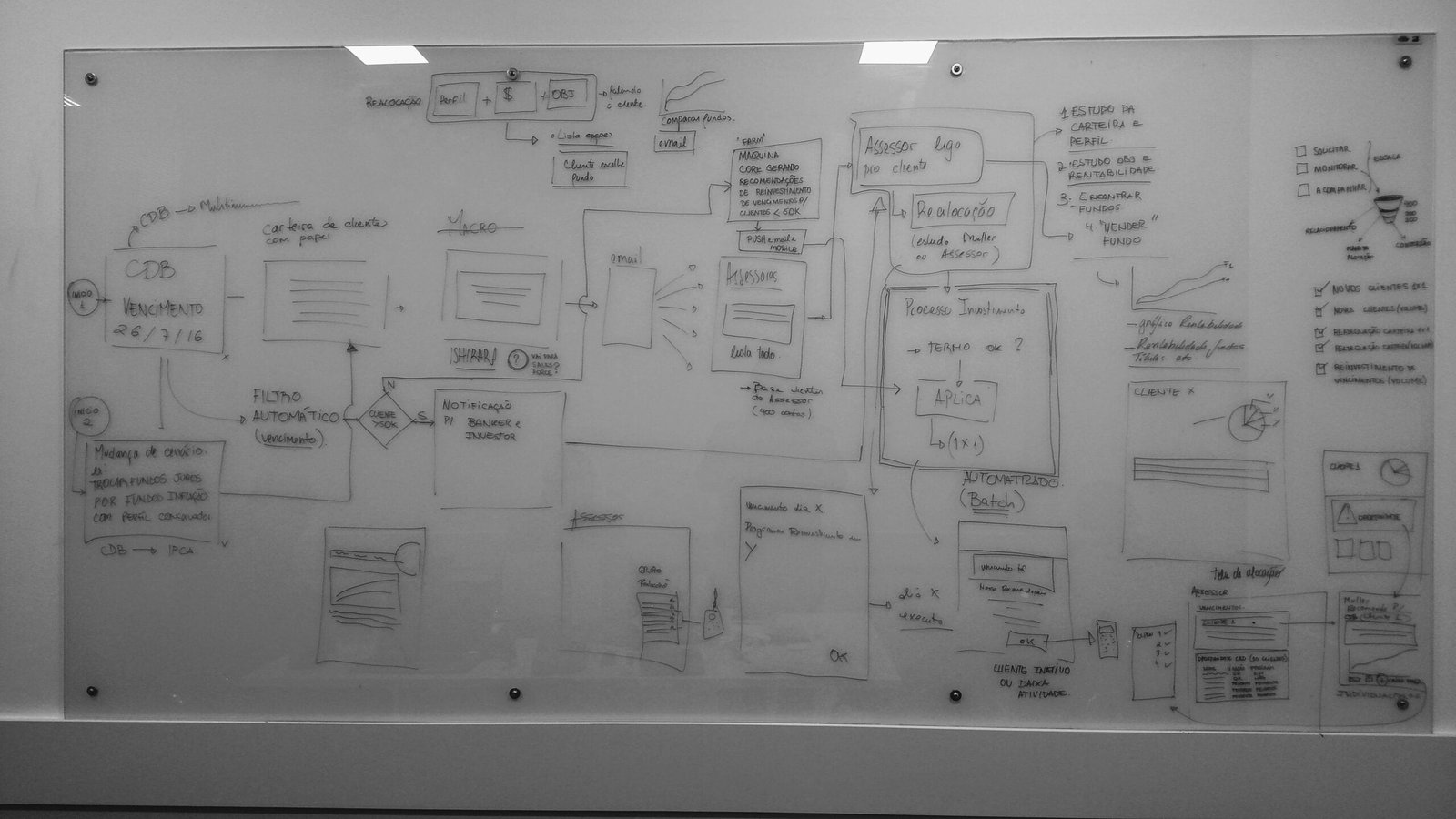

To understand the investment advisor's experience, I conducted shadowing sessions with them. I observed their workflows, including tracking client investments, researching potential investments, and communicating with clients.

However, the current platform's unintuitive interface created unnecessary friction, hindering their efficiency.

Leveraging these insights, I teamed up with advisors and other key players for co-creation sessions. All that effort resulted in the development of new features, improved navigation models, and enhanced client investment reports.

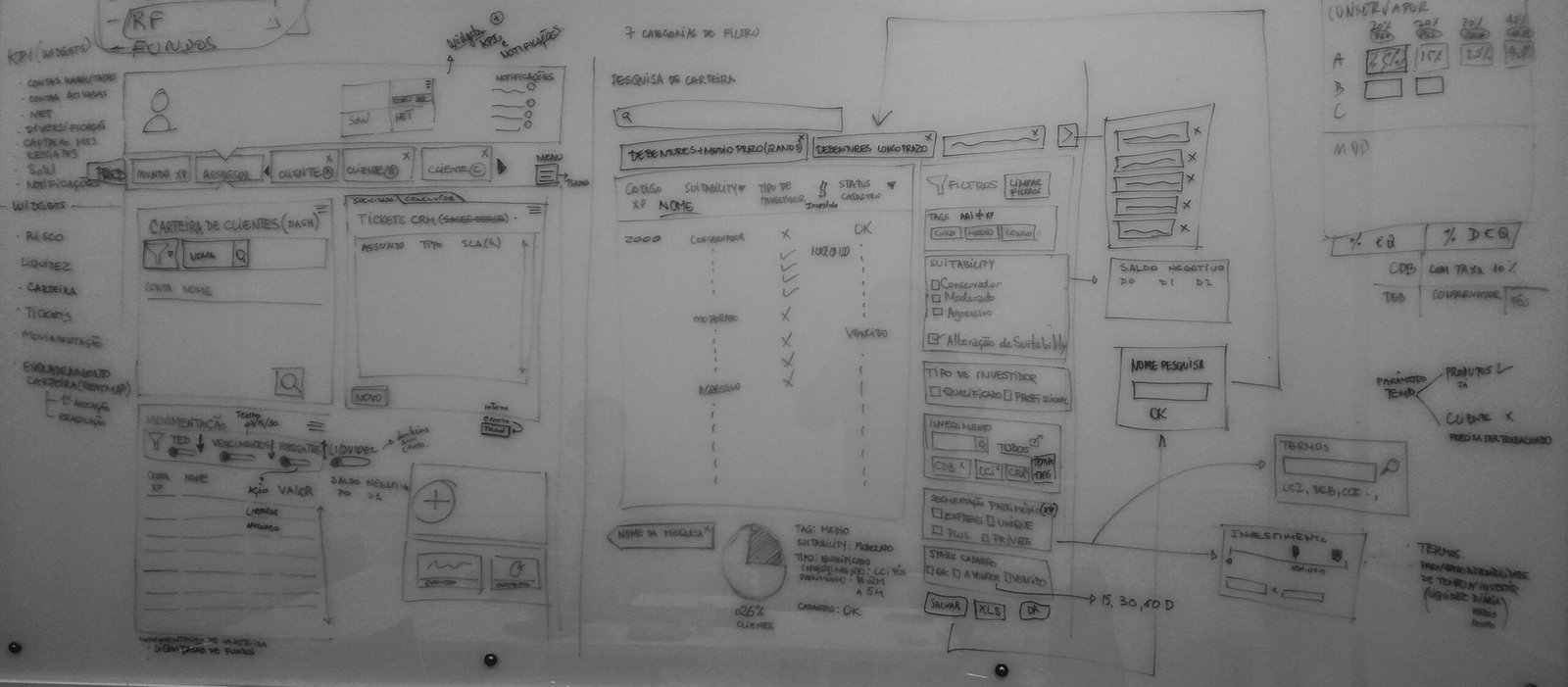

I used the valuable feedback from these co-creation sessions to design low-fidelity prototypes using Axure RP. I designed these prototypes to prioritize simplicity while maintaining realistic functionality.

Results

I conducted usability tests with real users. I validated the platform's new navigation model. The new client tracking tools eliminated repetitive manual tasks.

The platform passed the users' stress tests.

The new platform helped XP Investimentos establish strategic partnerships with new partner offices.

The new working platform allowed the network of partner offices to grow exponentially from 150 to 600 partners, a 300% increase.

The new platform has been instrumental in XP's growth. The number of users, including investment advisors, has surged from 3,000 to 10,000 in just 3 years, marking a 233% increase. Currently, XP's ecosystem connects 14,000 advisors, a staggering 367% increase since the new platform was launched in 2024.

Unique Features

Integrated navigation model

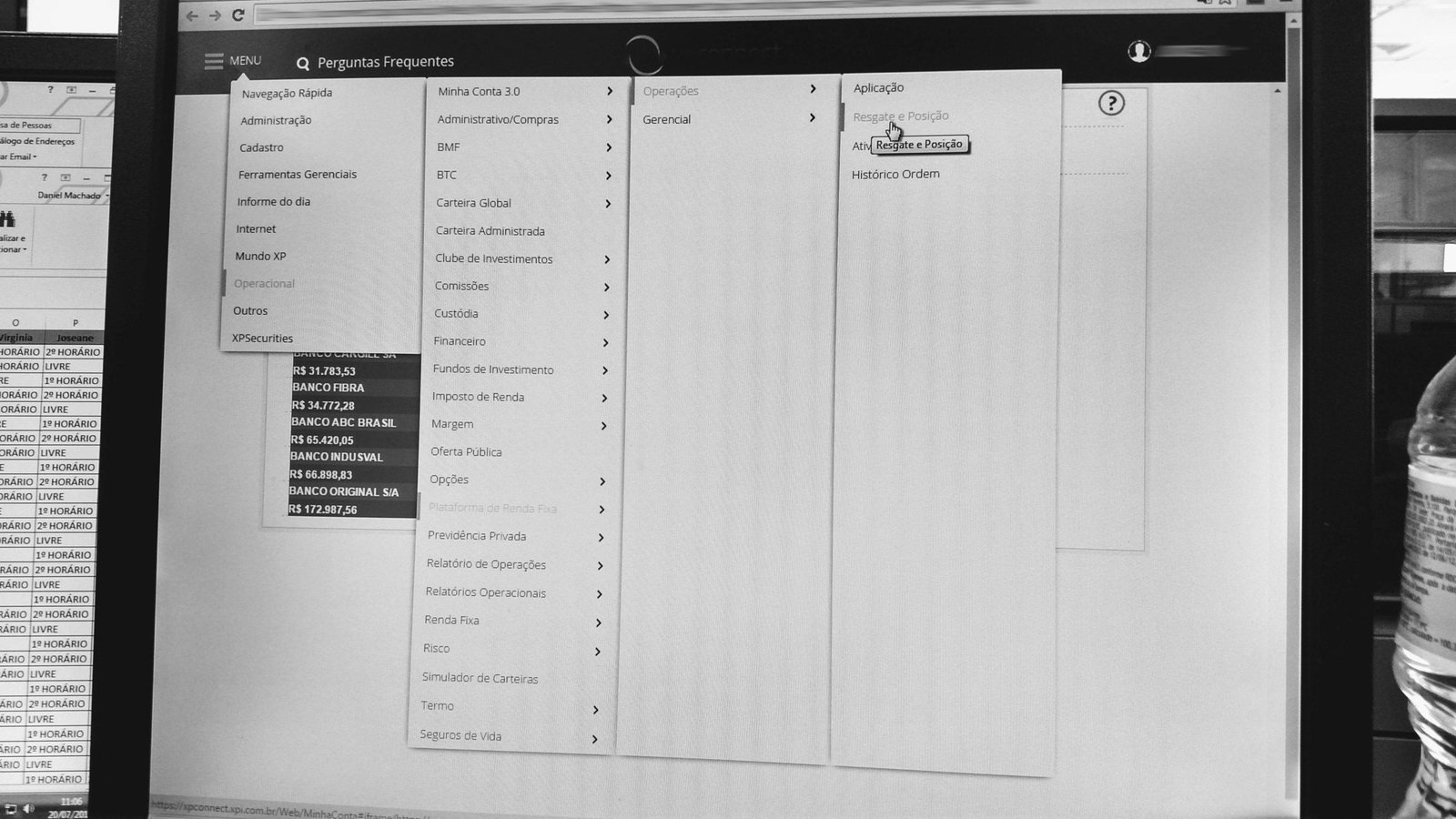

The previous platform menu had several usability issues and too many nested layers.

The result of a very fragmented environment and Investment Advisors had to look for several pieces of information on several different tools to report a customer what was their investment portfolio status.

This was the very first issue that needed to be handled.

The solution for this navigation issue was to create a navigation based on which kind of content Investment Advisor needed at the moment.

Research pointed out that Advisors were interested in managing their wallet of clients during the day.

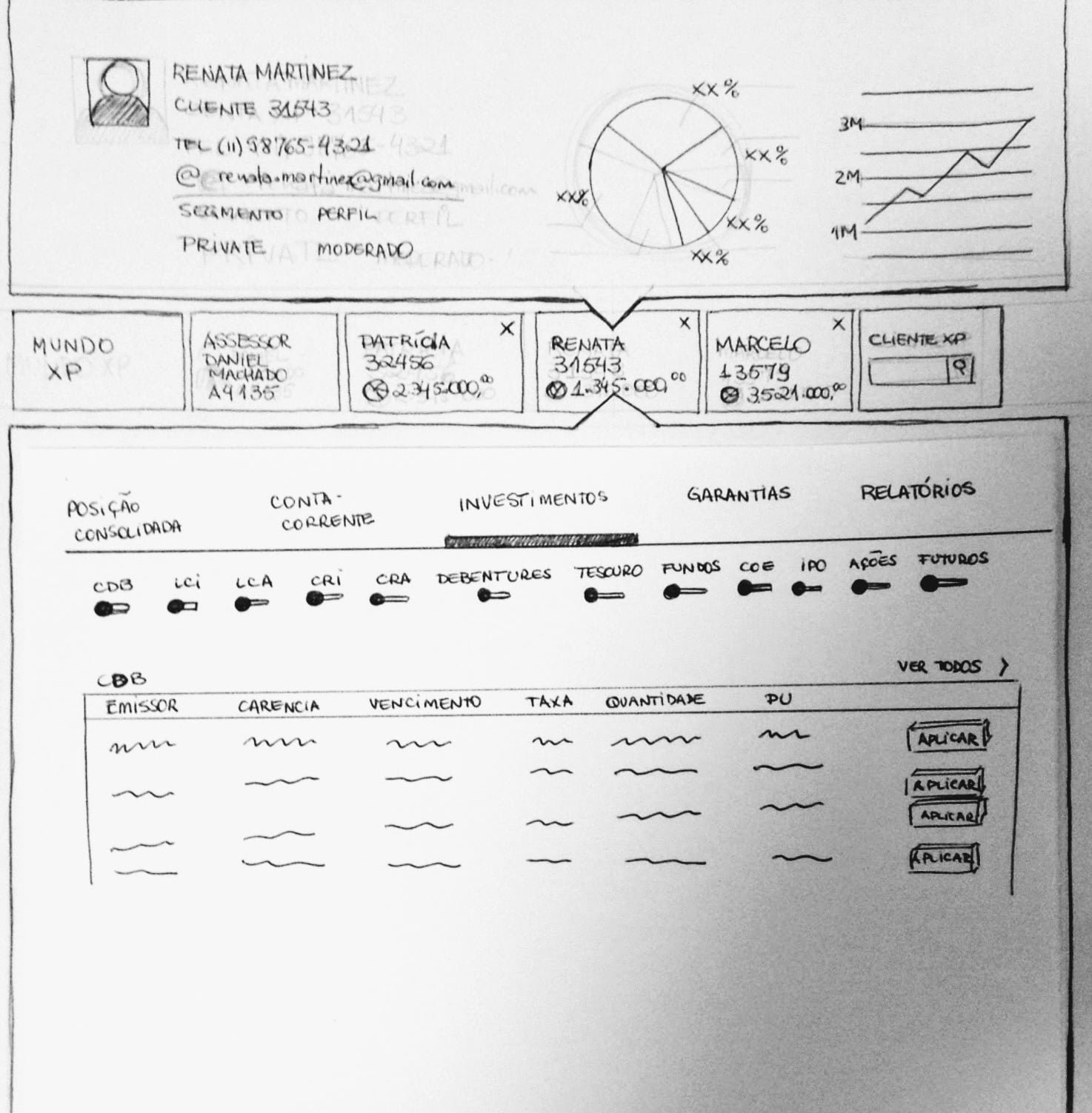

Based on that I have designed a tab system to handle several customers at one, but each tab would consolidate all customer investment assets and info.

This platform has 2 kinds of the tab: Investment Advisor and Clients.

Investment Advisor Tab is a fixed tab so he can check his goals and performance.

Client Tabs were designed so Investment Advisor could monitor and handle several customers at once. If advisor needs to look for a specific client, he searches for this clients and gets a Customer Tab session.

Each client will have his/her unique tab so all related content is concentrated in just one place.

Once all customers operations are checked then Investment Advisor can close this tab and move on to take care of another client.

My Work

Investor Advisors PlatformUX Research • Product Design

Banking App for SMB OwnersUX Research • Product Design

Freight Counter Offer ToolUX Research • Product Design